In a groundbreaking move for the jupiverse, Rain.fi announced the launch of its new feature, Liquid. Designed to provide instant liquidity for staked $jup tokens while preserving full staking rewards, Liquid is being hailed as a first-of-its-kind innovation on Solana. The initial rollout focuses on $JUP, Let’s dive into the details of this exciting development, explore its features.

What Is Liquid?

Rain.fi’s Liquid introduces a seamless way for $JUP holders to unlock liquidity from their staked tokens without sacrificing the benefits of staking. Liquid allows users to deposit $JUP tokens and receive a wrapped version called $stJUP. This wrapped token can then be used to borrow assets like $USDC, $SOL, and over 100 other tokens, all while remaining staked, retaining voting rights, and earning Active Staking Rewards (ASR).

Key Features of Liquid

1. Instant Liquidity Without Unstaking

By creating a wrapper for staked $JUP tokens ($stJUP),Liquid ensures users can access liquidity without the need to unstake. This is a significant improvement over traditional staking mechanisms, where users often face a trade-off between liquidity and staking rewards.

2. Full Staking Benefits

Users continue to earn staking rewards, participate in governance by voting, and qualify for Jupiter’s ASR rewards. This feature is particularly appealing for long-term $JUP holders who want to maximize their token utility.

3. Borrowing Made Simple

The process to borrow against $stJUP is straightforward:

- Stake $JUP on Rain.fi’s platform.

- Select "Borrow against stJUP."

- Choose the token to borrow (e.g., $USDC).

- Confirm the transaction, and the borrowed tokens are instantly credited to the user’s wallet.

|

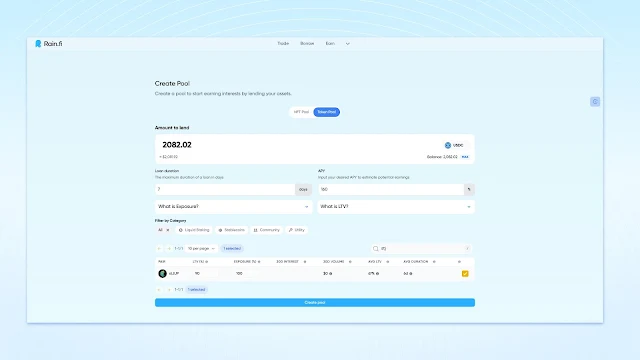

4. Lending Opportunities for Liquidity Providers

Rain.fi also caters to liquidity providers by allowing them to deposit tokens like $USDC or $SOL into lending pools. Providers can set their terms such as LTV, Annual Percentage Yield (APY), and duration and start earning yields. The platform emphasizes a peer-to-peer lending model with no price-based liquidations, a feature that sets it apart from many DeFi protocols.

5. Powered by Pyth Network

Rain.fi has partnered with Pyth Network to power the wrapping mechanism for $stJUP. This collaboration ensures accurate pricing and secure operations, leveraging Pyth’s robust oracle infrastructure.

How Does Liquid Work?

For Borrowing:

- Step 1: Deposit $JUP tokens on Rain.fi’s platform via the staking interface. A screenshot shows a staking screen with options to stake $JUP, displaying "Voting Power" and an "Unstake" button.

- Step 2: Receive $stJUP in return, which represents the staked $JUP in a liquid form.

- Step 3: Use $stJUP to borrow assets. For example, a user can borrow $USDC or $SOL instantly, with the borrowed amount credited to their wallet.

For Lending:

- Step 1: Deposit tokens like $USDC or $SOL into a lending pool.

- Step 2: Set terms such as LTV, APY, and duration. A screenshot illustrates a "Create Pool" interface where users can define these parameters.

- Step 3: Start earning yields as borrowers utilize the pool.

Rain.fi Liquid is the next evolution of staked assets on Solana, starting with $JUP.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Always conduct your own research before participating in DeFi protocols.

I will need to stake with their protocol?

ReplyDeleteYes

Delete